As we are aware, long-term investors always searching for early signs of emerging trends and try to make benefit out of it. Spotting the early changes can give you margin of safety and also gives you potent risk managing ability . RECENT FEW CHANGES IN DHANI

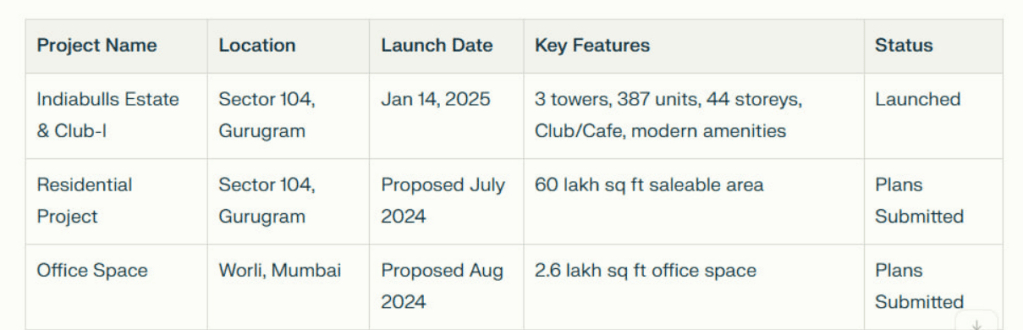

PROJECTS

PROJECTS DETAILS AND REALISABLE VALUE :

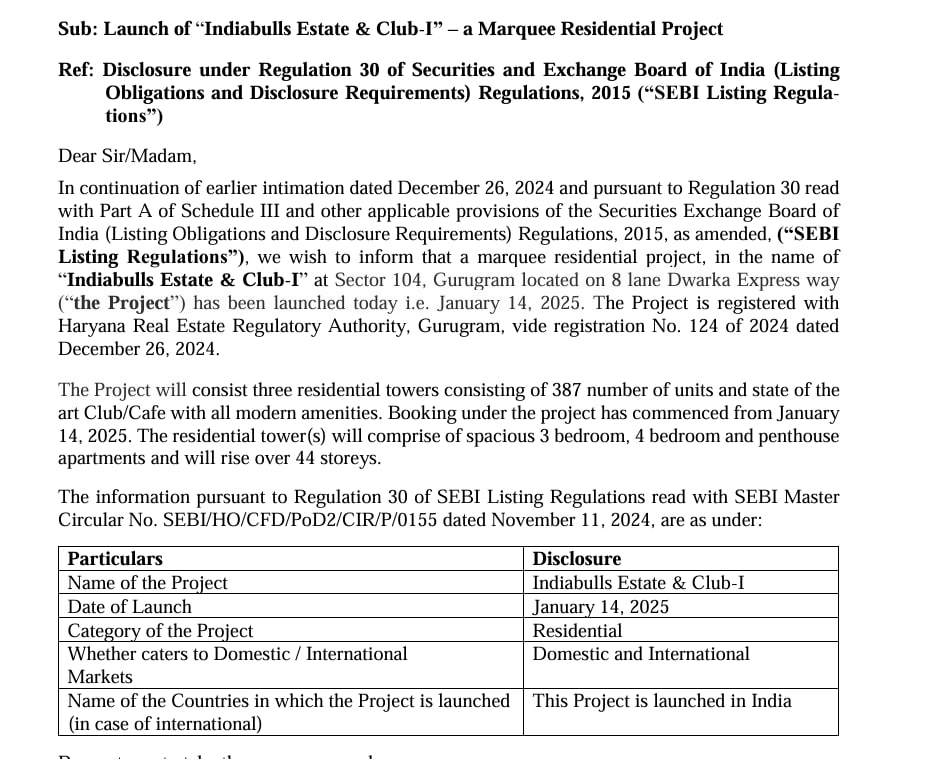

ANNOUNCEMENT about new projects

LINK WHERE WE WILL GET DETAILS ABOUT THE PROJECT

COMPANY MARKET CAP AT PRESENT : RS 4400 Crore

WARNIG AND RISK PART :Dhani Services Ltd (DSL) exhibits multiple red flags across capital allocation, financial reporting, and governance practices over the past decade, with patterns resembling Indian corporate fraud analogues.

Capital Raising & Fund Diversion Mechanics:aised capital via 3:16 rights issue at ₹238/share premium,but ₹5,776 Cr remains parked in “current investments” (March 2024)instead of stated growth objective Zero capex deployment despite ₹73 Cr fixed assets (2023)

2024 disclosure admits “no amount raised through Rights Issue” despite balance sheet entries

Shell Entity Likely Red Flags:2023 amalgamation scheme merged 12 subsidiaries into Yaari Digital creating opacity:

Subsidiaries like Savren Medicare (healthcare) & Juventus Estate (real estate) unrelated to core fintech operations

₹1,384 Cr short-term loans (2023) suggest inter-entity fund transfers before consolidation

FEW RED FLAG IN FINANCIAL METRICS :

- 81% decline in cash & equivalent despite fundraises

- Volatile lending book

- Sudden disappearance of contingent liabilities

- Despite fund raising collapses in core income

Promoter Playbook :Warrant Manipulation May 2025: Allotted 4.5Cr warrants to promoters at ₹90.304 during price slump (₹60-64 range)enabling future equity grab.

Subsidiary Shell Game

- Pre-2023 structure had 12+ subsidiaries across healthcare, real estate, tech – ideal for circular transactions

- 2023 merger created Yaari Digital, potentially burying historical transactions

Psychological Pattern

- Fundraise → Subsidiary investments → Capital erosion cycle repeats every 3-4 years

- Recent 43.93% standalone revenue drop3 matches 2017-18 underperformance post-rights issue

NEW UPDATES :Entry into Real Estate

Dhani Services Ltd entered the real estate sector primarily through the acquisition of subsidiaries from Indiabulls Real Estate. In 2022, Dhani acquired Juventus Estate and Mabon Properties for ₹240 crore, gaining access to a 35-acre land parcel near Dwarka Expressway, Gurugram. Juventus Estate alone reported revenues exceeding ₹1 crore in FY22, indicating operational real estate activity. This move marked Dhani’s strategic shift from purely financial services to property development and sales.

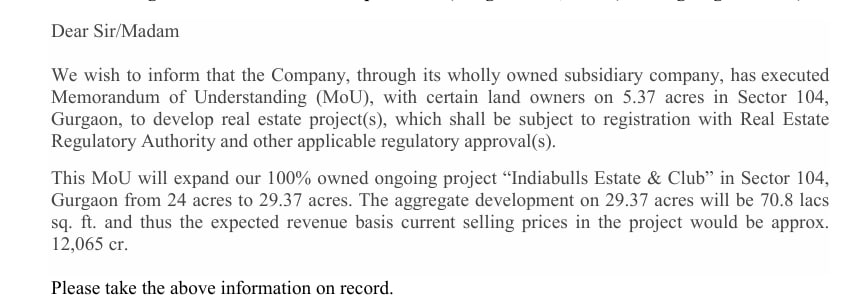

In March 2025, Dhani further expanded its real estate footprint by signing a Memorandum of Understanding (MoU) through a wholly owned subsidiary to develop a 5.37-acre plot in Gurgaon. This project, which will be integrated into the ongoing Indiabulls Estate & Club in Sector 104, increased the total development area to 29.37 acres, with a projected revenue of approximately ₹12,065 crore . These ventures are subject to RERA and other regulatory approvals.

RISK OR REWARD: WITH MULTIPLE PAST RED FLAG ALONG WITH OPPORTUNITY FROM NEW VENTURE.

DO YOUR OWN RESEARCH AND ANALYSIS, SHARED MY OWN DUE DILIGENCE, I MAY MISS MANY IMPORTANT ASPECTS.

Leave a comment