Privi Speciality Chemicals Ltd is India’s leading manufacturer, supplier, and exporter of aroma and fragrance chemicals. The company is globally recognized as a trusted partner and preferred supplier of bulk aroma chemicals used in soaps, detergents, shampoos, and fine fragrances.

Company Overview

- Founded: 1992 by Mr. Mahesh Babani, who remains the Managing Director.

- Headquarters and Facilities: State-of-the-art integrated manufacturing plants located in Mahad (Maharashtra) and Jhagadia (Gujarat), equipped to perform complex chemical reactions such as hydrogenation, condensation, Grignard reactions, pyrolysis, reactive distillation, and continuous distillation to ensure high quality and consistency.

- Product Portfolio: Over 50 aroma and fragrance chemicals, including key molecules like Dihydromyrcenol (DHMOL), Amber Fleur, Terpineol-Pine Oil, Galaxmusk, Florovane, Indomerane, and Amber Xtreme. DHMOL is used in 99% of contemporary perfumes as a freshness molecule, highlighting Privi’s dominant market position.

CAPACITY EXPANSION :Plants operated at 85–90% capacity; expansion planned from 48,000 MT to 54,000 MT by March 2026

Premium Product Pipeline

They’re doubling down on high-margin aroma and fragrance chemicals like Indomerane, Florovane, and Amber Woody Xtreme. These are gaining traction in personal and home care, where demand remains resilient and pricing power is higher.

Launched new products: Indomerane, Florovane, Amber Woody Xtreme – used in personal care and home care

Targeting sustainable 20–25% revenue growth; confident of maintaining >20% EBITDA margin

Improving asset turnover ratio from 1.4x to 1.7x, enhancing capital efficiency

Geographical Diversification: With only ~7% of revenues from the U.S., they’re emphasizing growth in underpenetrated and fast-developing markets like Africa, Asia, and the Middle East. They’re also leveraging “China Plus One” and “Europe Plus One” strategies as global supply chains pivot toward diversification.

Customer Count Is Expanding: Management stated they’ve moved from primarily servicing three key customers to now engaging with six top-tier clients, and are already working with most of the global top ten fragrance and FMCG players.

New Geographies, New Clients: They’ve gained at least five new sizable customers, especially from Africa, Asia, and the Middle East, aligning with their geographic diversification strategy.

Deeper Wallet Share + New Additions: While growing the number of customers, they’re also increasing share of business from existing clients through co-development and tailored solutions

Market Size and Growth Projections

The market was valued at approximately USD 5.60 billion in 2023 and is projected to grow to around USD 5.88 billion in 2024.

By 2030, the market size is expected to reach between USD 7.7 billion and USD 10.7 billion depending on the source.Aroma Chemicals Market To Reach $7.72 Billion By 2030

Asia Pacific dominates the aroma chemicals market, holding around 30-40% market share as of 2023-2025, driven by countries like China, India, and Japan.

Emerging markets in the Middle East, Africa, and Latin America are expected to contribute to future growth due to rising consumer awareness and expanding personal care industries.

Market Drivers and Trends

- Increasing consumer preference for natural, organic, and sustainable aroma chemicals is a key growth driver, especially in developed economies.

- The aromatherapy industry’s expansion, driven by rising demand for natural essential oils and fragrances for wellness and stress relief, is boosting aroma chemical consumption..

- Growth in cosmetics, toiletries, soaps, detergents, and food & beverage sectors is fueling demand for aroma chemicals due to their role in enhancing sensory appeal.

- Advances in biotechnology, green chemistry, and digital formulation tools are enabling innovation in aroma chemical production, including nature-identical and biodegradable compounds.

- Regulatory scrutiny and sustainability initiatives are shaping market dynamics, with companies focusing on eco-friendly sourcing and manufacturing processes.

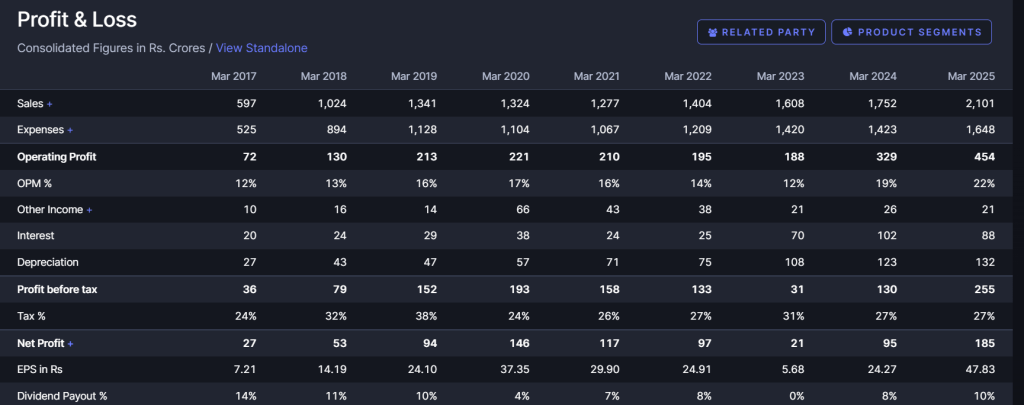

FINANCIAL HIGHLIGHT

ABLE TO HOLD MARKET SHARE OVER LAST MULTIPLE YEARS SHOWS THE TRUST AND ABILTY OF THE COMPANY BUILD OVER A YEARS.

INCREASING PROFIT MARGIN : NOT ONLY SCALE UP ALSO ABLE TO SUSTAIN PROFIT MARGIN SHOWS COMMAND IN GLOBAL MARKET

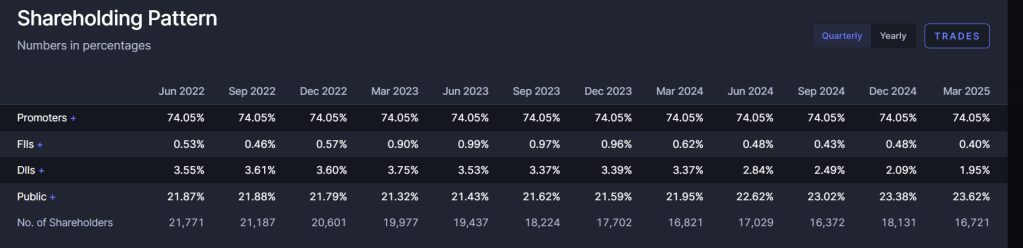

OCF >PAT , NUMBER OF PUBLIC SHAREHOLDERS SLOWLY DECREASING , STABLE BALANCE SHEET WITH HIGH ASSET ADDITION SHOWS PROPER USE OF RESERVE AND DEBT TOWARDS GROWTH

PROFIT AND PRICE GROWTH IN SYNC =FAIRLY VALUED .

NOT A RECOMMENDATION TO BUY OR SELL. KEEPING RECORDS AS MY FUTURE REFERENCE .

Leave a comment