Suumaya Industries Ltd exhibits multiple red flags indicative of financial misconduct, fund diversion, and governance breakdown over the many years. Key concerns include aggressive capital raising through rights and preferential issues with unclear or inconsistent fund deployment, significant anomalies in financial statements such as sharp divergences between CFO and PAT, surges in receivables and payables, and heavy related party transactions.

Suumaya Industries has raised funds through multiple routes, including rights issues and a large preferential issue in August 2023.

Suumaya Industries Ltd has repeatedly used equity-based fund-raising mechanisms—preferential allotments, warrant conversions, and public/bonus issues—over the past several years. This pattern, when cross-referenced with financial anomalies and related party dealings, strongly suggests a risk of fund diversion through these routes.

Frequent Preferential Allotments and Warrant Conversions:

The company has raised capital via preferential issues and warrant conversions almost every year since lsiting, often at significant premiums. This aggressive capital raising, especially through private placements and preferential routes, is a classic setup for fund diversion—funds are raised ostensibly for business growth but may be routed elsewhere through opaque channels.

For instance, despite significant capital raising, capital expenditure (capex) and fixed assets have remained largely stagnant or inconsistent .

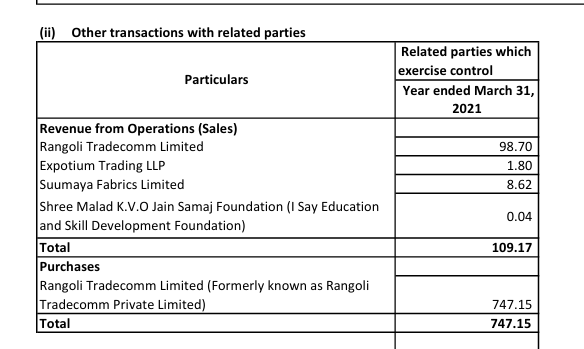

Related party transactions are substantial, with purchases from Rangoli Tradecomm Limited exceeding Rs 747 Cr and significant trade payables to the same entity (Rs 715.65 Cr in FY21), indicating possible circular transactions or fund routing

Financials: Patterns, Anomalies & Fabrications:

Sharp divergence between Cash Flow from Operations (CFO) and Profit After Tax (PAT), with PAT rising sharply in recent years

first company has surged payable through related party transactions to inflate sales and piled up inventory then followed by Surges in trade receivables.

It looks really good to see growth of the topline, but as a prudent investor one has to dig further when you see sudden surge in growth

OPERATING PROFIT AND PAT JUST AN accounting entry in books real cash realisation we will see in your SINDOOK or Cash flow .

गल्ले में पैसे होने चाहिए” only books main Nahi.

Here as an investor if anyone paid attention in cash flow would have identified easily what exactly company has done.

lets not complicate further and look at few odd figures which one can identify just going through a financial statement.

SURGRS IN SALES = ATTRACTIVE FINANCIAL NUMBERS TO TRAP RETAIL INVESTOR WHO DOESNT LOOK BEYOOND SALES AND PROFIT.

HOW THEY COOKED AND FOOLED MANY :

I WILL NOT TALK EXACT NUMBERS RATHER WILL LOOK INTO THE GROSS PICUTRE..

IN 2020,THE COMPANY WAS QUOTING RS 100 CR MARKET CAP ,GONE UP TO 20X ++ SAY 2200 CR Market cap

NOW QUOTING AT 19 CR ,WIPED OUT 2180 CR. SUCH AN EASY WAY TO MAKE MONEY AND TRAP RETAIL BY ANNOUCING ONE IPO.

HENCE ALWAYS AVOID BUSINESSES WITH SURGE IN SALES BUT CASH FLOW IS NOT IN SYNC WITH PROFIT .

The company reported extremely high sales figures that were not backed by actual cash flows. For example, However, during this period, the company’s cash flows from operations were a very small percentage of the recorded revenue.

In FY21 and FY22, cash flow from operating activities constituted only 0.39 per cent and 0.10 per cent, respectively.

During this period, the company’s shares experienced an exceptional surge from Rs 62.25 apiece in October 2020 to a peak of Rs 701.8 in July 2021.

The company engaged in circular trading, where transactions were repeatedly recorded among related entities to artificially boost turnover and valuations. Only about 10% of the transactions were legitimate, while the rest were fabricated to mislead investors and inflate share prices. Promoters diverted funds for personal gain and used complex transactions to “clean up” their books.

The promoters, including key executives like Ushik Gala and Ishita Gala, were barred by SEBI from holding any directorial or key positions due to their involvement.

During the COVID-19 pandemic, Suumaya Industries claimed to supply agro products under the Haryana government’s “Need to Feed” program, but investigations found no evidence of any contract or actual supply. Fake lorry receipts and invoices were created to substantiate these false claims.

Promoter Playbook: Tactics, Shells, and Related Entities:

- Promoter share pledging is significant, with insiders like Ushik Gala and Ishita Gala selling shares worth crores recently, indicating possible financial stress or exit attempts.

- Loans to promoters and related parties, coupled with large trade transactions with entities like Rangoli Tradecomm Limited (likely promoter-affiliated), suggest circular fund flows and value extraction through backdoor ownership or shell companies.

- Insider trading data shows concentrated selling by promoter individuals in June 2024, coinciding with fundraising rounds, possibly to manage liquidity or reduce exposure.

- The promoter group’s strategic decisions, including board changes and auditor switches, appear timed around fundraising events and share pledge releases, indicating attempts to manage market perception and regulatory scrutiny.

Governance Failures & Regulatory Arbitrage

- Frequent auditor changes and limited transparency in related party disclosures undermine governance.

Cross-Case Comparisons

- Similarities with DHFL and PC Jeweller cases include aggressive fund raising followed by opaque related party transactions and promoter pledging leading to value extraction.

- Like Satyam, Suumaya shows divergence in reported profits vs cash flows and sudden changes in auditor and board composition.

- Systemic loopholes exploited include weak enforcement of related party transaction disclosures, promoter pledge monitoring, and delayed regulatory intervention.

Learning for an Investor from the Suumaya Industries Fraud Case

1. Beware of Aggressive Fundraising Without Clear Asset Growth

Suumaya raised large sums repeatedly via preferential allotments, warrant conversions, and rights issues, yet showed little corresponding capital expenditure or asset creation. This mismatch is a classic red flag indicating possible fund diversion or misuse rather than genuine business expansion24.

2. Scrutinize Related Party Transactions and Circular Deals

The company’s financials revealed massive related party transactions and circular trading patterns inflating turnover artificially. Such practices often mask siphoning of funds to promoter-affiliated or shell entities, undermining real value

3. Watch for Divergence Between Reported Revenues and Actual Cash Flows

Suumaya reported skyrocketing sales but received only a fraction in cash, with dues mysteriously written off. This disconnect between reported earnings and cash inflows is a strong indicator of fictitious sales and financial manipulation.

4.Investor Due Diligence Must Go Beyond Surface Financials

Relying solely on reported revenues and profits without analyzing cash flows, related party dealings, auditor reports, and promoter activities can be perilous. Investors should demand transparency and perform forensic-level scrutiny, especially in companies with complex fundraising and ownership structures.

Leave a comment