THE ABOVE ARTICLE Gujarat: GMDC examining potential of copper and precious metals at Ambaji reserve | Ahmedabad News – Times of India 2022

recent concall-update

An Investor in Indian Stock Market for the past 15 years,

Mail me at – rupakroyc@the-valuepicker.com

Disclaimer: This Blog,its owner,creator & contributor is neither a Research Analyst nor an Investment Advisor and expressing opinion only as an Investor in Indian equities. He/She is not responsible for any loss arising out of any information, post or opinion appearing on this blog.Investors are advised to do own due diligence and/or consult financial consultant before acting on any such information. Author of this blog not providing any paid service and not sending bulk mails/SMS to anyone.

THE ABOVE ARTICLE Gujarat: GMDC examining potential of copper and precious metals at Ambaji reserve | Ahmedabad News – Times of India 2022

recent concall-update

Patent expiry results in significant revenue loss for pharmaceutical companies primarily because it allows generic manufacturers to enter the market with bioequivalent versions of the drug at substantially lower prices. This increased competition leads to a sharp decline in sales and market share for the original branded drug.

Key reasons for revenue loss after patent expiry include:

Example:

Natco Pharma operates in two main segments: Pharmaceuticals and Agrochemicals. Its pharmaceutical portfolio includes generic oncology drugs and complex specialty medicines. The company has a strong presence in both domestic and international markets, with operations in over 50 countries. It is known for launching generic versions of important drugs in the US market, such as Tamiflu, glatiramer acetate for multiple sclerosis, blood cancer drug Pomalidomide, and the multiple myeloma drug Revlimid

Revenue Concentration Risk: A significant portion of Natco’s revenue and profits has historically depended on a few blockbuster drugs like generic Revlimid. The eventual patent expiration of such drugs (e.g., Revlimid expected FY27) creates revenue replacement risk.

So, patent expiry transforms a protected, high-margin branded drug into a highly competitive, low-margin generic commodity, leading to steep revenue and profit declines for the original pharmaceutical company

Certainly! Here’s the story with a credit to Mr. Warren Buffett at the end:

Once upon a time, a young entrepreneur named Riya wanted to start a business selling incense sticks. She had two choices for her stall location: one spot right in front of a bustling school and another just outside a peaceful temple.

Riya thought, “If I set up near the school, I’ll see lots of students and teachers passing by every day. That should bring me good business!” So, she opened her stall there.

But days turned into months, and Riya noticed very few customers buying incense sticks near the school. The students were busy with their classes, and incense sticks weren’t something they needed or wanted. Her revenue was low, and she wondered if she could grow her business at all.

Curious, Riya decided to try the other location—the temple. The moment she set up her stall there, she saw a steady stream of visitors lighting incense as part of their prayers and rituals. People came every day, and her sales began to rise.

Over the next three years, Riya’s incense stick business flourished. She even opened two more stalls near other temples in the city. The demand was strong because the location matched the product perfectly.

Riya learned an important lesson: The right location creates demand.

And where there is demand, there is growth and cash flow. With more cash, she could expand her business further or share profits with those who helped her succeed.

So, whether you’re selling lemonade or incense sticks, remember—finding the right place is the first step toward turning your idea into a thriving business.

This story and lesson are inspired by Mr. Warren Buffett’s famous “Lemons to Lemonade” episode from the Secret Millionaires Club, teaching us the power of location and demand in business.

FOR AN EXAMPLE

SOLAR BUSINESS = REQUIRE MORE SUN LIGHT = SO LOCATION NOT ARUNACHAL ,WILL FLOURISH IN RAJASHTAN AND GUJARAT,

LIKE WISE HYDROPOWER BUSINESS WILL DO GOOD ARUNACHAL /UTTARAKHAND BUT NOT IN RAJASHTHAN

SJVN major hydro projects are from HIMAHCAL ,UTTARAKHAND AND ARUNACHAL PRADESH

Likewise Solar EPC companies in India are headquartered in Maharashtra and Gujarat, while their project execution happens heavily in Rajasthan, Gujarat, Tamil Nadu, and Karnataka, due to favorable solar radiation and policy support.

Waaree Renewable Technologies Ltd,KPI Green : Project Location: Gujarat

Sterling and Wilson Renewable Energy Ltd :project location: Rajasthan

As we are aware, long-term investors always searching for early signs of emerging trends and try to make benefit out of it. Spotting the early changes can give you margin of safety and also gives you potent risk managing ability . RECENT FEW CHANGES IN DHANI

PROJECTS

PROJECTS DETAILS AND REALISABLE VALUE :

ANNOUNCEMENT about new projects

LINK WHERE WE WILL GET DETAILS ABOUT THE PROJECT

COMPANY MARKET CAP AT PRESENT : RS 4400 Crore

WARNIG AND RISK PART :Dhani Services Ltd (DSL) exhibits multiple red flags across capital allocation, financial reporting, and governance practices over the past decade, with patterns resembling Indian corporate fraud analogues.

Capital Raising & Fund Diversion Mechanics:aised capital via 3:16 rights issue at ₹238/share premium,but ₹5,776 Cr remains parked in “current investments” (March 2024)instead of stated growth objective Zero capex deployment despite ₹73 Cr fixed assets (2023)

2024 disclosure admits “no amount raised through Rights Issue” despite balance sheet entries

Shell Entity Likely Red Flags:2023 amalgamation scheme merged 12 subsidiaries into Yaari Digital creating opacity:

Subsidiaries like Savren Medicare (healthcare) & Juventus Estate (real estate) unrelated to core fintech operations

₹1,384 Cr short-term loans (2023) suggest inter-entity fund transfers before consolidation

FEW RED FLAG IN FINANCIAL METRICS :

Promoter Playbook :Warrant Manipulation May 2025: Allotted 4.5Cr warrants to promoters at ₹90.304 during price slump (₹60-64 range)enabling future equity grab.

Subsidiary Shell Game

Psychological Pattern

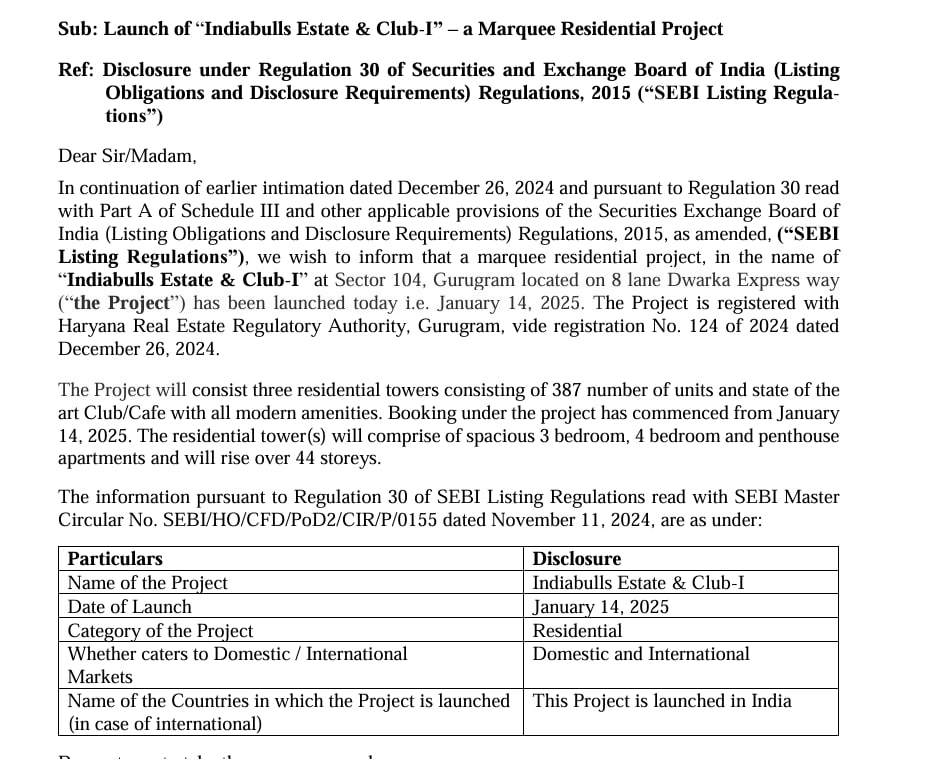

NEW UPDATES :Entry into Real Estate

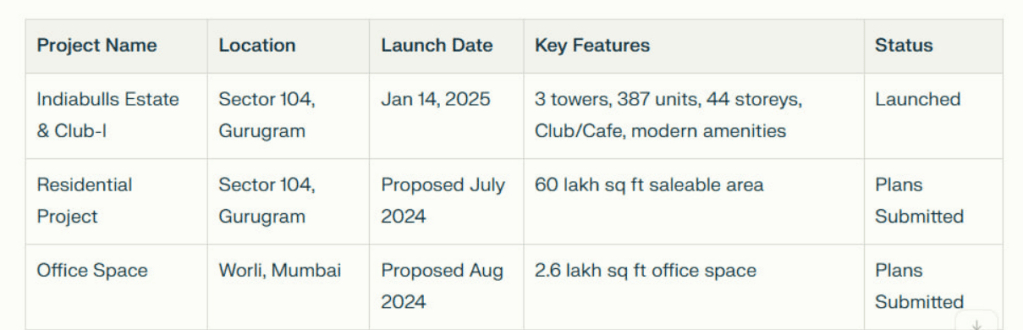

Dhani Services Ltd entered the real estate sector primarily through the acquisition of subsidiaries from Indiabulls Real Estate. In 2022, Dhani acquired Juventus Estate and Mabon Properties for ₹240 crore, gaining access to a 35-acre land parcel near Dwarka Expressway, Gurugram. Juventus Estate alone reported revenues exceeding ₹1 crore in FY22, indicating operational real estate activity. This move marked Dhani’s strategic shift from purely financial services to property development and sales.

In March 2025, Dhani further expanded its real estate footprint by signing a Memorandum of Understanding (MoU) through a wholly owned subsidiary to develop a 5.37-acre plot in Gurgaon. This project, which will be integrated into the ongoing Indiabulls Estate & Club in Sector 104, increased the total development area to 29.37 acres, with a projected revenue of approximately ₹12,065 crore . These ventures are subject to RERA and other regulatory approvals.

RISK OR REWARD: WITH MULTIPLE PAST RED FLAG ALONG WITH OPPORTUNITY FROM NEW VENTURE.

DO YOUR OWN RESEARCH AND ANALYSIS, SHARED MY OWN DUE DILIGENCE, I MAY MISS MANY IMPORTANT ASPECTS.

FINDING GEMS

✅ If a stock has lakhs of shareholders…it’s probably already done its major move.

✅ If everyone owns it, who’s left to buy and push it higher?

✅ If a stock is widely popular, it’s often priced for perfection-and leaves little margin of safety.

Big Shift only can happen

When you don’t chase hype.

don’t get carried away by how “famous” a stock is.

Instead, I look for:

Scalable businesses with low public shareholding

Visionary promoters who understand capital allocation.

Stocks where the crowd hasn’t arrived yet .

Because true wealth is created before the spotlight arrives-not after.

Welcome to WordPress! This is your first post. Edit or delete it to take the first step in your blogging journey.